Insurance for Cancer – Plans, Features, Details, and Benefits of Purchasing

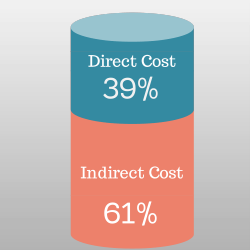

Did you know that 61% of the cost associated with cancer are non-medicare?*

Did you know that 1 in 2 men and women will be diagnosed with cancer during their lifetime?**

Whether you have an individual health insurance policy, group insurance coverage, or on Medicare with a Medigap plan, a cancer insurance plan will help you cover unexpected costs.

Cancer plans are modernized to work with you and not your current health insurance policy. Health insurance policies are now built with maximum out-of-pocket medical expenses which help individuals pay for their healthcare. Cancer plans are designed to pay cash benefits directly to you and not providers.

Cancer Insurance Plan Benefits

Individuals may use the cancer policy’s cash benefits for:

- Supplementing Lost Income

- Pay for Experimental Treatments and Surgeries

- Take a Recuperative Trip / Vacation

- Cover Medical Co-Payments, Coinsurance, and Deductibles

- Allow for Extra Time Off Work

- Provide Cash for Car or Mortgage Payments

Issue Ages for Cancer Plans: 0-85

Coverage: Individual, Single Parent, Couple, and Family

Cancer Lump Sum Benefit Amounts: $10,000 Minimum – $75,000 Maximum

Cancer Insurance Plan Re-occurrence Benefit

You will receive a lump sum benefit amount (that you choose) that’s paid directly to you as defined in your policy. Benefits are restored in a period of remission for at least 1 full year from the previously diagnosed cancer. The Cancer Plan’s Re-occurrence Benefit is a percentage of the lump sum benefit paid when cancer reoccurs. See the benefit percentage below for cancer re-occurrence benefits:

- Year 1 – 10%

- Year 2-3 – 25%

- Year 4 – 50%

- Year 5+ – 100%

How much does a cancer insurance plan cost?

Cancer plans depend on age, your location (state), etc. Get a free unbiased quote by calling Retirement Transitions at (402) 805-4626. Protect yourself, your family, and supplement your health insurance by purchasing a policy.

Cancer Plans will not pay for a benefit for the following reasons:

1. Any cancer diagnosed before the insurance policy effective date.

2. Any loss due to injury, disease or incapacity, unless related to or attributable to Cancer as defined – Call for details

Call and speak with a specialist to see if you’re eligible for a Cancer Insurance Plan. Get more details and quotes by calling Retirement Transitions at (402) 805-4626

Information provided by Guaranteed Trust Life (GTL) Cancer insurance plans.