Grand Island Nebraska Medicare Supplement Insurance Coverage and Medigap Quotes Comparison

Grand Island Nebraska – Learning about Nebraska Medicare Supplement Plans in Grand Island is an excellent way to get the most out of your Medicare Supplement Insurance. Protect yourself by gathering information and researching what plans are available in Grand Island, NE. First, you need to understand that “Nebraska Medicare Supplement Insurance” is also called “Nebraska Medigap Insurance” to clear any confusion.

Medicare is for seniors who are 65 and older. In some cases, for individuals who’re disabled or have End Stage Renal Disease (ESRD). Medicare doesn’t provide comprehensive insurance coverage. There are gaps in Medicare’s health insurance such as deductibles, coinsurance, and copay’s. This is why we refer to supplemental insurance as “Nebraska Medigap“. The gaps in coverage is the reason people purchase Nebraska Medicare Supplements in Grand Island.

Brief Overview:

Grand Island, NE – What is Medicare?

There are 4 main parts of Medicare:

1. Part A (Hospitalization Coverage)

2. Part B (Medical Coverage)

3. Part C (Medicare Advantage Plans)

4. Part D (Prescription Drug Coverage)

Medicare Part A provides hospital insurance coverage. The 2020 Part A deductible is $1,408.

Medicare Part B provides medical insurance coverage. The standard insurance premium for Part B is $144.60. This amount is generally deducted from your Social Security check each month. The 2020 Medicare Part B deductible is $198. Once the Part B insurance deductible is met, your coinsurance is usually 20% of the cost.

Note: There is no maximum-out-of-pocket limit with Medicare.

Medicare Part C is offered by private insurance companies. Part C is Medicare Advantage. Medicare Advantage Plans often included Part D prescription drug coverage. Visit Medicare.gov to learn more about Part C plans.

Part D is your prescription drug insurance coverage. Part D is offered through private insurance companies. Even if you’ don’t take any prescriptions, it’s smart to enroll into a Part D plan to avoid late enrollment penalties.

To elect your Medicare Insurance benefits Part A and Part B contact your local Grand Island U. S. Social Security Administration Office:

115 N. Web Rd. Ste 1Grand Island, NE 68803

1-877-407-3441

You can apply online for your Medicare Insurance coverage on the Social Security website for Medicare Benefits.

What Type of Supplemental Insurance Plan Do I Need?

Nebraska Medicare Supplemental Insurance plans in Grand Island provides coverage to fill the gaps of Medicare. Medigap policies are designed by Medicare, so the plans are standardized between insurance companies. Each plan must have the exact same benefits from one carrier to the next. The main difference is the price the insurance company charges for the plan.

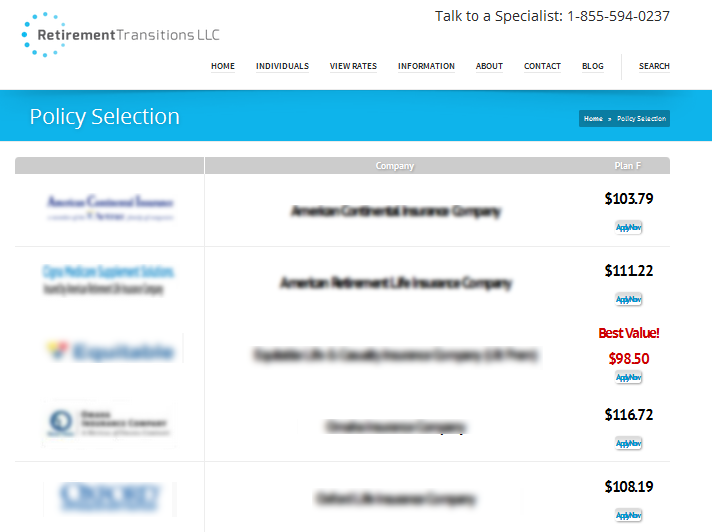

When comparing Nebraska Medicare Supplement companies who offer Medigap plans in Grand Island, there’s no reason to pay more money for a certain company over another. Grand Island residents should compare multiple Nebraska Medicare Supplement Insurance quotes to find the lowest rates. Again, the coverage for each specific Nebraska Medigap Plan is exactly the same across companies.

Nebraska Medigap Quote Comparison

Shopping for Medicare Plans in Grand Island, NE? Calling multiple insurance companies for quotes is a hassle and time consuming. Instead of dealing with insurance companies, consider running Nebraska Medicare Supplement quotes online. Compare Nebraska Medigap rates from several top carriers instantly. The best part of all, people have saved a lot of money by comparing supplemental insurance quotes.

View your Grand Island, NE health insurance quotes and connect with a local health insurance agent.

If you prefer to talk to one of Retirement Transitions’ Nebraska Medicare insurance agents over the phone, call 402-805-4626 or toll-free 1-855-594-0237. Know that a Specialist will guide you every step of the way.

Page Updated August 21, 2019 by Retirement Transitions