Iowa Medicare Supplement Plans and IA Medigap Insurance Quotes, Prices, and get the Best Coverage

Iowa Medicare Supplement Plans are also known as Medigap Insurance. Learn about the basics of Medicare, Medicare supplement plans, quotes, and which insurance company offers plans in your area. See which Iowa Medigap plan has the best coverage and find the companies with the most affordable prices. It’s not uncommon to be under-insured and paying more than someone with comprehensive coverage. Start with the basics to prepare yourself for Medicare and get the best supplemental insurance at the lowest cost.

Medicare in Iowa

Before jumping straight into supplemental insurance, reviewing the basics of Medicare in Iowa is key to finding the best Medigap plan for you. Medicare is a federal health insurance program available for:

- Age 65 and older

- Under 65 and have been on Social Security disability for 24 months.

- No wait is required if you’re diagnosed with ALS or Lou Gehrig disease.

- Those who have end-stage renal disease.

The 4 main parts to Medicare:

- Part A – Hospitalization Coverage

- Part B – Medical Coverage

- Part C – Medicare Advantage “MA” or “MAPD”

- Part D – Prescription Drug Coverage

Medicare Part A is usually automatically given to individuals when they turn 65, worked and paid taxes, and are U.S. citizens. Part A helps cover hospitalization, skilled nursing facility care, home health care, hospice care, and blood. Part A has you pay deductibles and co-pays. We refer to these as the “Gaps” of Medicare.

Medicare Part B has a standard premium of $148.50 a month. This amount, for most people, is automatically deducted from your monthly Social Security check. Part B covers medical expenses, outpatient hospital treatment, laboratory, home healthcare, durable medical equipment, blood, etc.. The gaps of Part B include a deductible, coinsurance, and co-pays.

Medicare Part D is prescription drug coverage. It’s offered by approved private insurance companies. To view prescription drug coverage in Iowa, go to the Medicare website. Plans aren’t the same in every service area. Give us a call for more information.

Medicare Part C is an advantage plan. This is coverage that pays instead of original Medicare. You cannot have an Iowa Medigap Plan and Part C at the same time.

Iowa Medicare Supplement Plans

If you’re looking for an Iowa Medicare supplement plan, you must be turning 65 or older and have Medicare Parts A and B to apply for a policy. There are standardized supplemental insurance plans that provide benefits for seniors to help fill the Gaps in Medicare:

- Deductibles and Coinsurance

- Excess Charges

- Non-covered services

There are 10 standardized Iowa Medicare Supplement insurance policies available that are identified by the letters A, B, C, D, F, G, K, L, M, and N. These supplemental insurance plans are offered by private insurance companies.

Contact an Iowa Medicare Supplement Insurance Specialist.

Find the best Medigap Plans in Iowa online

Which Iowa Medigap Plan has the best supplemental coverage?

From experience, the most popular policy seniors purchase in Iowa is the Medigap Plan G. Plan G is considered by many as “the best supplemental coverage.” It provides comprehensive benefits to help fill the gaps of Medicare.

Each individual has different health insurance needs. Learning about the plans will help you find which Iowa Medigap plan is the best for you. What one person may think is the best Medigap plan, the next person may think otherwise.

Medicare Supplement Rates in Iowa

Depending on which policy you’re purchasing, makes a big difference on the price you pay. Medicare Supplement Plan A has the least amount of benefits, but costs less than the popular Plan G. The more coverage the plan provides, usually the more expensive it costs. We’ve seen people with less coverage and actually pay more for their policy than Plan G. This is not uncommon.

We find that individuals aren’t shown all their options and didn’t shop around for multiple Medicare supplement rates. No worries. You can change Medicare Supplemental Plans in Iowa anytime during the year.

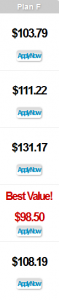

The best Medicare Supplement Plan in Iowa to purchase is Medigap Plan G. Plan F use to be the most popular. The only difference is the Medicare Part B deductible. The 2021 annual deductible is only $203. Once the deductible is met, Medicare Plan G in Iowa equals Plan F. It’s an easy way to save money and have excellent supplemental coverage.

We talked about how Medigap Plans in Iowa are standardized, that means that there’s no difference in coverage levels between insurance companies. For the exact same coverage, comparing supplemental insurance companies rates in Iowa is the best way to get the most out of Medicare. Find Medicare Supplement prices in Iowa by giving us a call or using our Medigap quote engine. Get comprehensive insurance coverage at the most affordable price by comparing rates online.

Get Medigap Price Quotes in IA

Getting Medigap prices from multiple supplemental insurance companies isn’t difficult. Within 5 minutes, you can receive quotes from top supplement insurance carriers.

3 easy ways to get the best Medicare Supplement rates in Iowa

- Compare Medicare Quotes Online: We have a safe, secure, and private Medigap plan G quote engine that allows you to easily access rates from top insurance companies. Enter your information and instantly see your personal prices. We promise you won’t be called multiple times and your information is kept safe and secure. Contact one of our licensed Iowa Medigap Insurance Agents.

- Call Us: Speak to an unbiased licensed Medicare insurance specialist. No waiting on hold like most insurance companies make you do. We have a strict no-nuisance policy, so you don’t have to worry about being pushed into any plan or conversation you’re not interested in.

- By Mail: By calling our toll-free phone number or Email Me and we will mail your personal Iowa Medicare Supplement rates from over 20 companies!

Retirement Transitions 301 S. 70th St. #126 Lincoln, NE 68510 (402) 805-4626