What is the best Medicare Supplement Insurance Plan?

There are 10 Medicare Supplement Plans available. It’s important to choose affordable supplemental coverage and meets your needs. Medicare is always changing. Staying up-to-date on the changes helps determine which insurance plan will best supplement Medicare coverage. Now and in the future.

What Medicare Supplement Plan should I select?

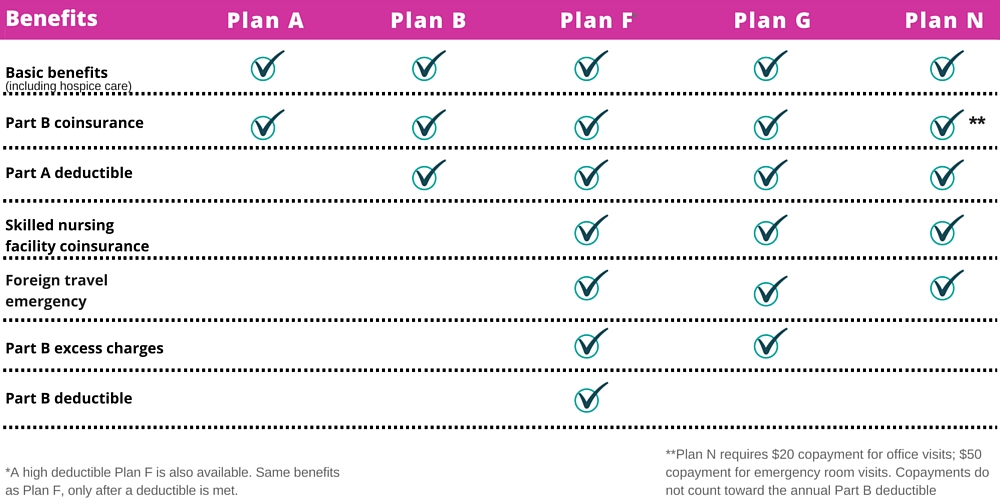

Get a Medicare Supplement Plan G. Although Plan F provides the most coverage out of all supplemental plans, Plan F is changing in 2020. Medigap Plan G is the future of Medicare Supplement Plans.

That is why I now consider Medigap Plan G the best Medicare Supplement Plan. The majority of Retirement Transitions clients own a G policy. The remaining are in the process of changing plans. You can change Medicare supplements throughout the year. Medicare Supplement Plan F was the best option until 2020. Plan G is the best plan available. People on an F should try to switch to G.

The Medicare Plan G coverage is excellent. The only difference between Plan G and F is the Medicare Part B deductible. After the deductible is met, Plan G equals Plan F. You won’t have to worry about medical bills piling-up. If you have to go to the hospital, you don’t have to reach a deductible. It’s paid.

You won’t have to worry about networks anymore like PPO’s or HMO’s. You have the freedom to choose the doctors you trust. Also, no copayments when you see your doctors after the Part B annual deductible ($198) is met. After Medicare pays 80%, Plan G pays the other 20% that you would have to pay for services like: hospitals, surgeries, emergency rooms, observation, skilled nursing, physical therapy, labs, X-rays, etc..

Plan G saves you from thousands in out-of-pocket expenses!

- Pays Medicare Part A annual deductible

- Plan G pays Medicare Part B excess charges

- No 20% coinsurance

- Offers guarantee issue in special circumstances

Is Medicare Plan G expensive?

Let me tell you. Plan G can be expensive if someone doesn’t show you options from multiple Medicare supplement insurance companies.

Like many people, you may be on a fixed-income. The best way to save money is to compare Medicare Plan G rates from well-known companies.

Why compare Medicare Supplement Insurance Companies that offer Medicare Plan G?

Medicare Supplement Plans are standardized. This means the coverage for Medicare Plan G is the same no matter which insurance company you choose. To save money, it’s best to compare multiple insurance companies.

Luckily, Retirement Transitions is a 100% independent insurance agency.

You will be able to compare the cost of Medicare Supplement Plan G from the nation’s leading insurance companies. Gathered from all of our companies, you will see top-to-bottom rates starting with the lowest priced Plan G companies first.

It’s that simple! In under an hour, you are done…and saved money!

We care about each and every person as we care for our loved ones.

Retirement Transitions – A 100% independent agency for seniors

Call me direct at 402-805-4626 to get help finding the best Medicare supplement plans in your area. We help save seniors money everyday!

Dan Owens – Medicare Insurance Help

It’s my opinion that “the best Medicare Supplement Insurance Plan” is Plan G. If you feel differently, please share your thoughts below.